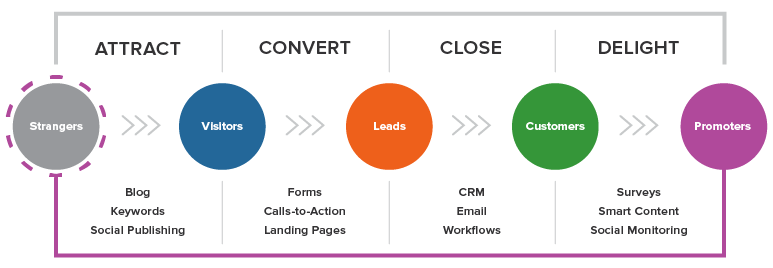

Referral fees are a great way for real estate agents to increase their client base. Referral fees enable agents to increase customer base without taking up time or sacrificing other business tasks. In addition, they allow them to be highly rewarded for offering a service.

Referral Fees to Realtors

Referring is one of your best ways to grow your business. Some of your past clients and customers may have relatives or friends who are interested in buying or selling a house. In exchange, you can ask for a referral payment.

What Is a Referral Fee in Real Estate?

Referral fees are a percentage of gross commission that an agent earns. This amount can vary depending on how much business the agent has and what type of client they are referring.

Finder Fee for Real Estate

In some real estate markets, it can be difficult to find an investor to buy or sell a property. A middleman acts as an intermediary between investor and agent. This person may be a broker or an online service that has access to a network of investors and will help facilitate the transaction.

Investors pay a finder fees to the intermediary. The intermediary is responsible to follow all state and federal laws concerning broker fees and split commissions. HRS 467-14 (14 in Hawaii) provides that a broker's license can be revoked, suspended, or even imprisoned if he or she pays a finder fees to an unlicensed individual.

Can I Pay a Referral Fee If I'm Not There?

You need to know how referrals work in real-estate, whether you are a buyer, renter or homeowner. This information can give you a superpower, and help you get the most value from your real estate transaction.

What are the legalities surrounding a referral fee

Referral fees are paid by brokers in real estate. Brokers must sign a contract before they are allowed to earn commissions on sales. The contract typically specifies the percentage of gross commission that the referring agent will receive and other details about the relationship between them.

How do I calculate my referral fee?

A calculator is the best tool to calculate a referal fee. There are many options available online. You can also create your own with a simple formula.

What are the pros and disadvantages of paying a referal fee to a real estate agent?

It can be easier to select the right real estate agent to help with your next deal if you have a solid understanding of how referrals work. It can help you decide if the risk of transferring your business is worth it.

FAQ

Do I require flood insurance?

Flood Insurance protects from flood-related damage. Flood insurance helps protect your belongings, and your mortgage payments. Learn more information about flood insurance.

What should I look for in a mortgage broker?

Mortgage brokers help people who may not be eligible for traditional mortgages. They work with a variety of lenders to find the best deal. Some brokers charge fees for this service. Other brokers offer no-cost services.

How much will my home cost?

This varies greatly based on several factors, such as the condition of your home and the amount of time it has been on the market. According to Zillow.com, the average home selling price in the US is $203,000 This

What are the benefits associated with a fixed mortgage rate?

With a fixed-rate mortgage, you lock in the interest rate for the life of the loan. This guarantees that your interest rate will not rise. Fixed-rate loans offer lower payments due to the fact that they're locked for a fixed term.

What is the maximum number of times I can refinance my mortgage?

This is dependent on whether the mortgage broker or another lender you use to refinance. Refinances are usually allowed once every five years in both cases.

Should I rent or purchase a condo?

Renting may be a better option if you only plan to stay in your condo a few months. Renting can help you avoid monthly maintenance fees. However, purchasing a condo grants you ownership rights to the unit. You have the freedom to use the space however you like.

Is it possible to sell a house fast?

It might be possible to sell your house quickly, if your goal is to move out within the next few month. But there are some important things you need to know before selling your house. First, find a buyer for your house and then negotiate a contract. Second, prepare your property for sale. Third, you need to advertise your property. Lastly, you must accept any offers you receive.

Statistics

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

External Links

How To

How to Find Houses to Rent

Moving to a new area is not easy. But finding the right house can take some time. When you are looking for a home, many factors will affect your decision-making process. These factors include price, location, size, number, amenities, and so forth.

We recommend you begin looking for properties as soon as possible to ensure you get the best deal. Also, ask your friends, family, landlords, real-estate agents, and property mangers for recommendations. You'll be able to select from many options.