Real estate investing is a great way to diversify your investment portfolio. Real estate investment is an excellent choice for many reasons. You should be careful about the risks and high returns. Real estate is not only risky but also requires maintenance and insurance. This article discusses the steps you should take in order to avoid common pitfalls. This article also serves as a guideline for novice investors who wish to diversify.

Real estate investment is a great way of diversifying your investment portfolio

Real estate investing can be a great way of diversifying your portfolio and avoiding high-risk investments. Real estate can be a great way to diversify your portfolio, enjoy cash flow from rental properties, appreciation, and significant capital gains in retirement. Investing in real estate is not for everyone, but it is a smart choice for those who want to minimize risk while generating significant returns.

Real estate has a low correlation to other types such as stocks or bonds. In fact, it usually rises and falls after all the rest of the economy. Each real estate market is unique, so factors that sink the value of a home in one market may not affect it in another. CFP Daniel Kern of TFC Financial Management in Boston states that it is smart to allocate between five and ten percent of total investments to real property.

It is a wise financial decision

Real estate is an appealing option when it comes to diversifying portfolios. There is very little correlation with stock markets, and many investors consider real estate a smart investment to reduce overall losses. There is no guarantee that you will make a profit and there are likely to be losses. This article will cover the main benefits to investing in real-estate. This article will also cover the main benefits of investing in real estate.

Real estate can be a bankable asset and provide steady income. Because you can borrow against property value, you don't need a large amount of cash upfront. You can also use bank money to increase your investment. You can take advantage of low interest rates which are like having free money. Real estate investment can bring you tax benefits.

This requires a team of professionals

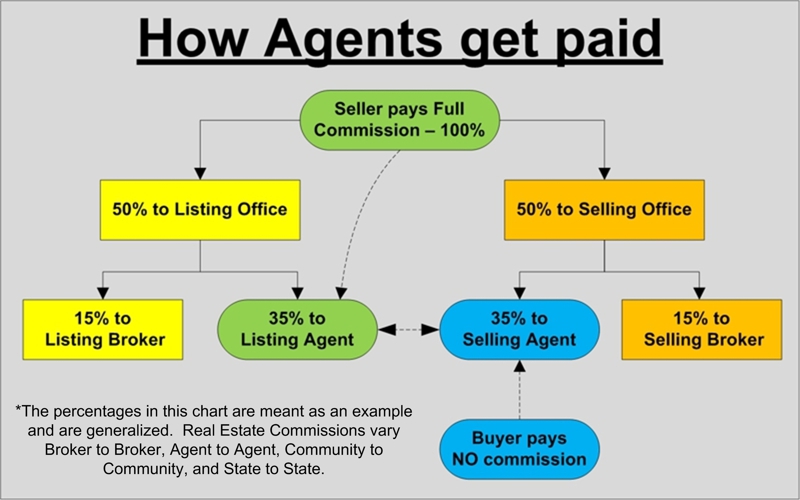

You need the right people to help you build a team for your real-estate ventures. Perform thorough due diligence on every potential team member before hiring. Ask for recommendations and contact references if you can. Your niche, market, as well as strategy are important for getting the best results from your real estate company. The key to success is a team that works well together.

A legal counsel is essential when it comes to real estate investing, as they will make sure all paperwork is in order and that any evictions follow the law. You will also need a bookkeeper that has expertise in real estate investing. This is necessary to keep track and organize finances. Also essential is a marketing manager. Finally, a team is crucial for any successful real estate investing company.

You have many options.

There are many options for real estate investing. Some people use their own capital to purchase property. Others may pool funds. Depending upon your goals, you may buy or rent houses. Or, you could use money from others to renovate properties. You can make money from your investment in any way you choose. These are some of the ways that you can get into investing in real property. These strategies come with varying levels of difficulty and rewards.

A great way to invest in real-estate is to purchase a house, fix it up and then sell it at a higher cost. While this strategy is most lucrative, it can also be costly and time-consuming. Real estate investing can make you a successful investor if your patience is not strained. You can also invest in a few properties at once and make a large profit.

FAQ

How do I calculate my rate of interest?

Market conditions influence the market and interest rates can change daily. The average interest rates for the last week were 4.39%. Divide the length of your loan by the interest rates to calculate your interest rate. For example: If you finance $200,000 over 20 year at 5% per annum, your interest rates are 0.05 x 20% 1% which equals ten base points.

What can I do to fix my roof?

Roofs can leak due to age, wear, improper maintenance, or weather issues. Minor repairs and replacements can be done by roofing contractors. Get in touch with us to learn more.

How can I get rid of termites & other pests?

Termites and other pests will eat away at your home over time. They can cause damage to wooden structures such as furniture and decks. You can prevent this by hiring a professional pest control company that will inspect your home on a regular basis.

What are the benefits of a fixed-rate mortgage?

With a fixed-rate mortgage, you lock in the interest rate for the life of the loan. This means that you won't have to worry about rising rates. Fixed-rate loans have lower monthly payments, because they are locked in for a specific term.

Statistics

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

External Links

How To

How to Rent a House

Finding houses to rent is one of the most common tasks for people who want to move into new places. It can be difficult to find the right home. There are many factors that can influence your decision-making process in choosing a home. These factors include location, size and number of rooms as well as amenities and price range.

We recommend you begin looking for properties as soon as possible to ensure you get the best deal. You should also consider asking friends, family members, landlords, real estate agents, and property managers for recommendations. This will ensure that you have many options.